Managing risk

The Board recognises that the appropriate management of risk is key to the delivery of the Group’s strategic objectives.

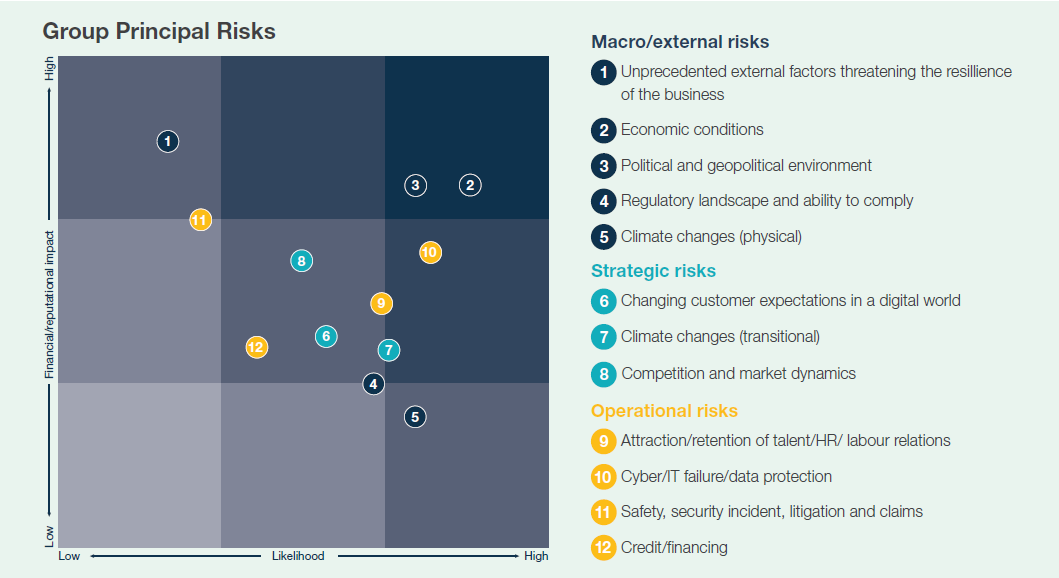

As a leading international transport company, the Group is exposed to an evolving landscape of risks, whether industry-wide or more specific to the Group, which could potentially impact performance or reputation negatively as well as positively.

The Board remains ultimately responsible for the effective management of risk in the Group, and is committed to driving continuous improvement and adopting best practice in this crucial area. In addition to the broad strategic responsibilities of the Board, it:

- approves the Group Risk Appetite Statement

- reviews and approves the Group Emerging Risks;

- reviews the principal risks faced by the Group and approves the Group Risk Register.