Our strategy

The  Strategy

Strategy

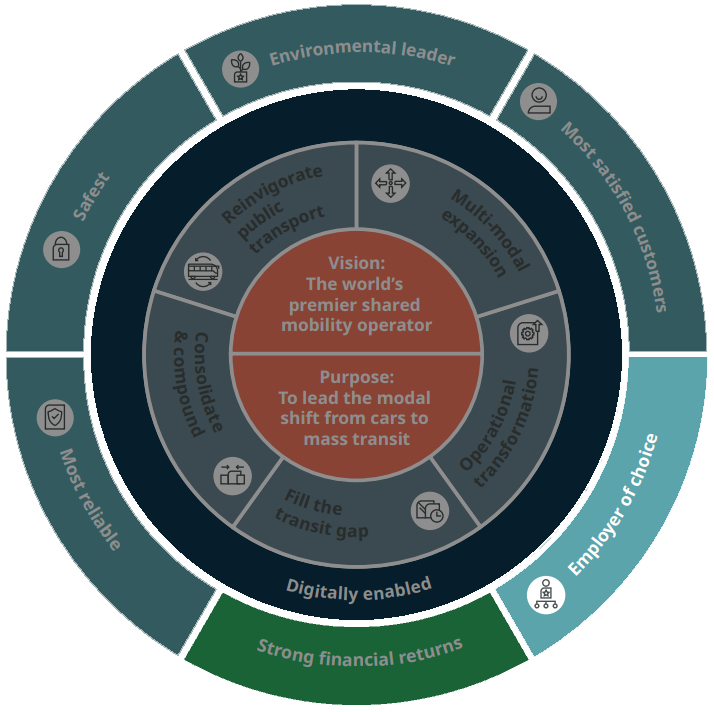

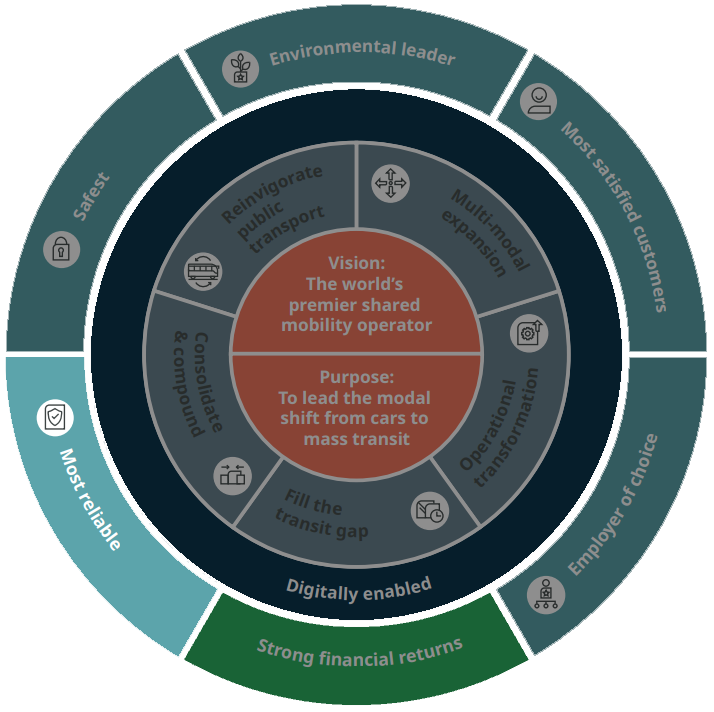

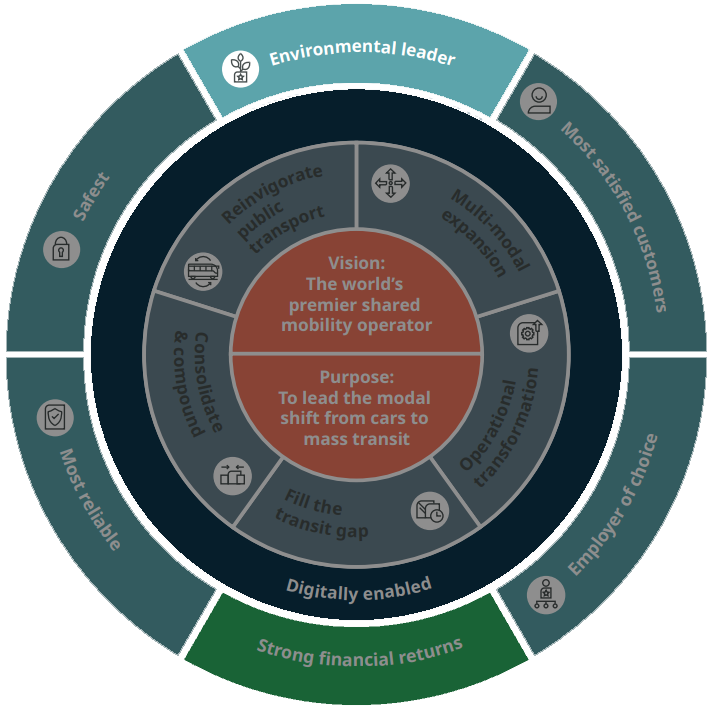

We have a clear vision and purpose, which drives everything we do...

...We deliver this through five customer propositions...

...Which are enabled by focused application of technology...

...To deliver superior outcomes for all our stakeholders...

Watch our latest video

Our five customer propositions

Underpinned by our focussed application of technology

-

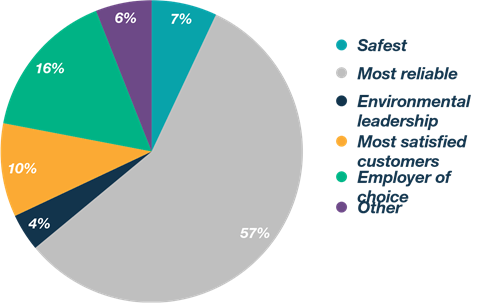

Most reliable

We will lead the industry in reliability by striving for ever increasing levels of punctuality, and driving down cancelled services and lost miles

KPI: OTP* and lost miles

A typical split of how customers award quality marks in assessing bids:

*On-time performance

-

Safest

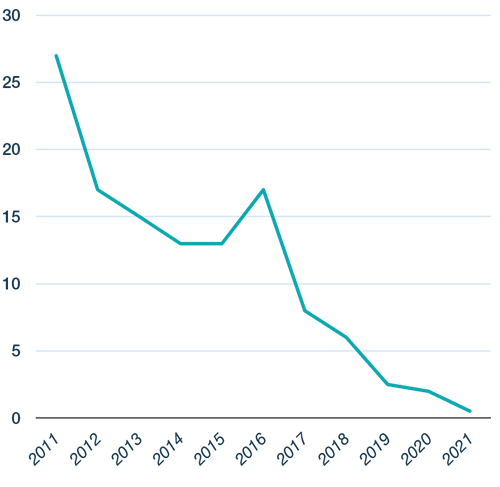

We will lead the industry in safety by continually driving down accidents

KPI: FWI*

*Fatalities weighted index

-

Environmental leader

We will lead the transition to zero emission vehicles

KPI: Vehicle emissions

Zero emission fleet targets

Scope 1 and 2 emissions net zero target

2040

-

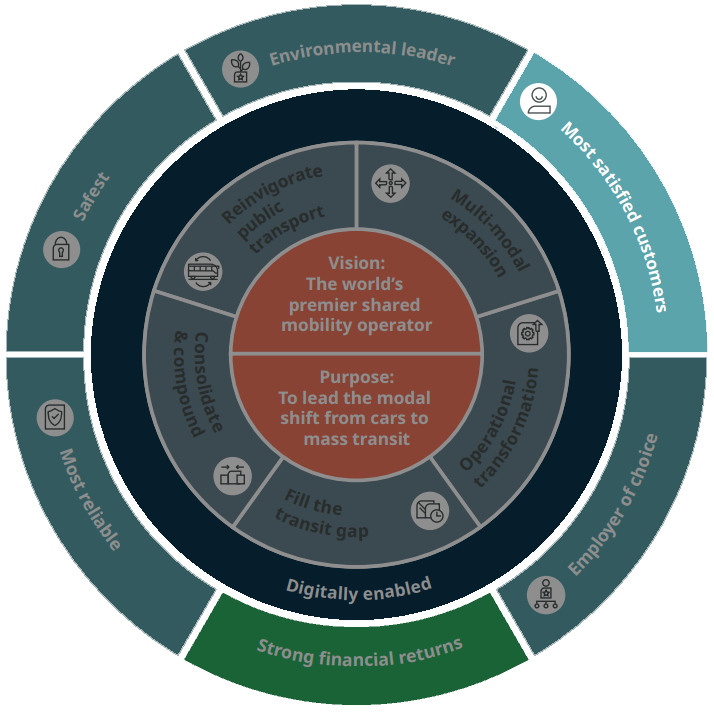

Most satisfied customers

Our customers will rate us the highest in the industry

KPI: Net promoter score

-

Employer of choice

We will embed a high performance culture that attracts and retains the best people

KPI: Employee net promoter score